38 turbotax home and business 2017 best price

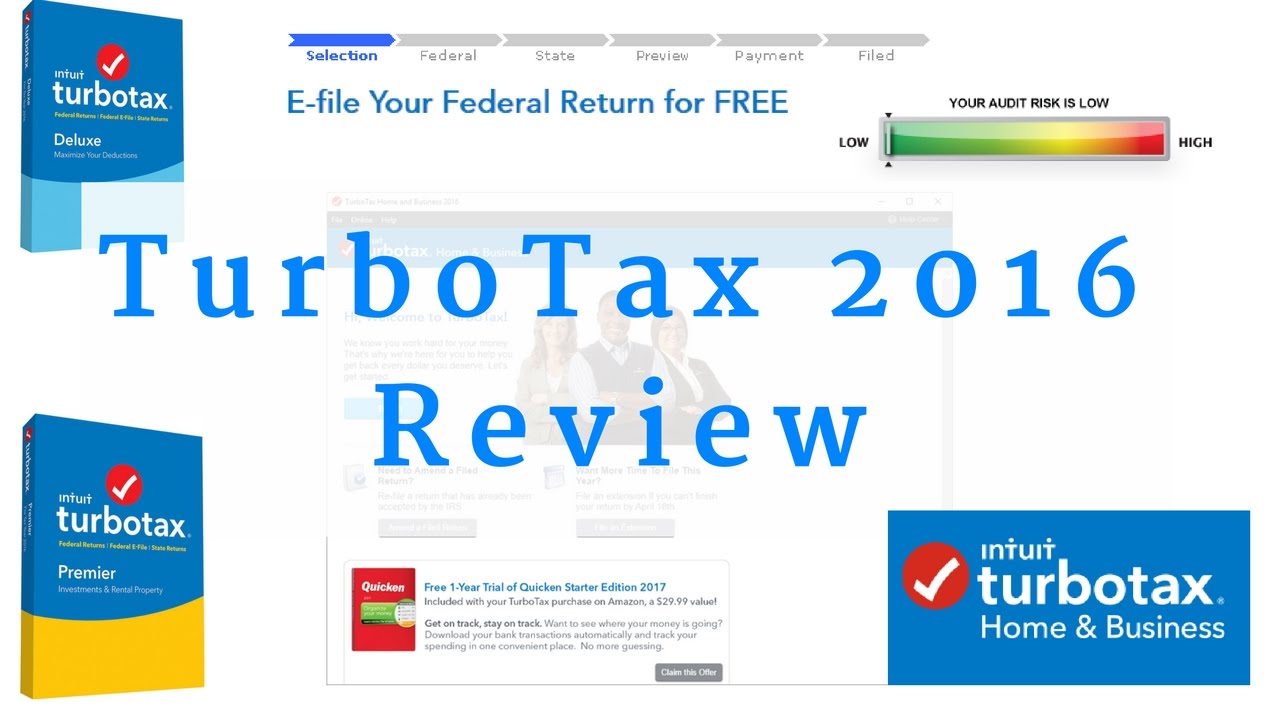

Turbo Tax Business Software for sale - eBay Get the best deals on Turbo Tax Business Software and find everything ... 2017 TurboTax Home & Business federal e-file & state tax return for PC & Mac CD. TurboTax 2017 On Sale Now - Top Financial Tools You file personal and business taxes on the same return; TurboTax Home & Business includes 5 federal and 1 state tax return preparation and efile. TurboTax ...

turbotax.intuit.com › personal-taxes › onlineTurboTax Live Assisted - Basic 2022-2023 Oct 18, 2022 · TurboTax Product Support: Customer service and product support hours and options vary by time of year. #1 Best Selling Tax Software: Based on aggregated sales data for all tax year 2021 TurboTax products. Deduct From Your Federal Refund: A $40 Refund Processing Service fee applies to this payment method. Prices are subject to change without notice.

Turbotax home and business 2017 best price

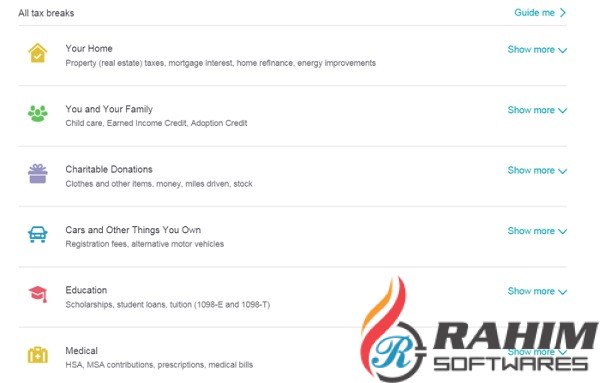

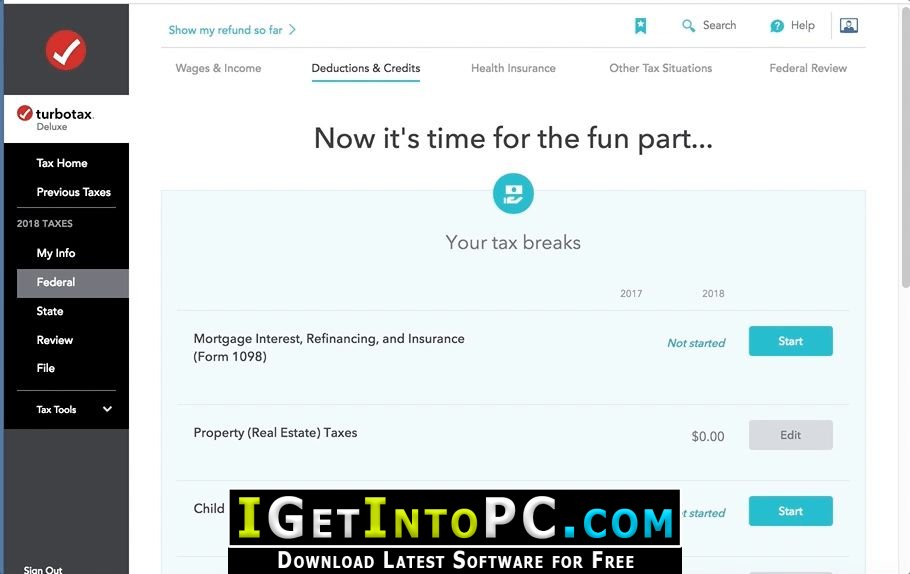

turbotax.intuit.com › tax-tips › home-ownershipHome Improvements and Your Taxes - TurboTax Tax Tips & Videos Dec 01, 2022 · TurboTax Product Support: Customer service and product support hours and options vary by time of year. #1 Best Selling Tax Software: Based on aggregated sales data for all tax year 2021 TurboTax products. Deduct From Your Federal Refund: A $40 Refund Processing Service fee applies to this payment method. Prices are subject to change without notice. Tax Support: Answers to Tax Questions | TurboTax® US Support WebThe TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics. Home Improvements and Your Taxes - TurboTax Tax Tips & Videos Web01/12/2022 · TurboTax Product Support: Customer service and product support hours and options vary by time of year. #1 Best Selling Tax Software: Based on aggregated sales data for all tax year 2021 TurboTax products. Deduct From Your Federal Refund: A $40 Refund Processing Service fee applies to this payment method. Prices are subject to change …

Turbotax home and business 2017 best price. turbotax.intuit.com › tax-tips › tax-deductions-and7 Best Tips to Lower Your Tax Bill from TurboTax Tax Experts Dec 01, 2022 · Audit Support Guarantee: If you receive an audit letter based on your 2022 TurboTax individual, TurboTax Live Assisted Business, or TurboTax Full Service Business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center, for audited returns filed with these products ... turbotax.intuit.com › tax-tips › familyTax Filing Requirements for Children - TurboTax Dec 01, 2022 · TurboTax Product Support: Customer service and product support hours and options vary by time of year. #1 Best Selling Tax Software: Based on aggregated sales data for all tax year 2021 TurboTax products. Deduct From Your Federal Refund: A $40 Refund Processing Service fee applies to this payment method. Prices are subject to change without notice. 2017 turbotax home and business - Amazon.com [Old Version] TurboTax Home & Business Desktop 2020 Tax Software, Federal and State Returns + Federal E-file [Amazon Exclusive] [PC Download]. by Intuit. Taking Business Tax Deductions - TurboTax Tax Tips & Videos - Intuit Dec 8, 2022 ... If you operate your business out of your home, a drive from your home to a ... Often, the best way to do this is with a written log of your ...

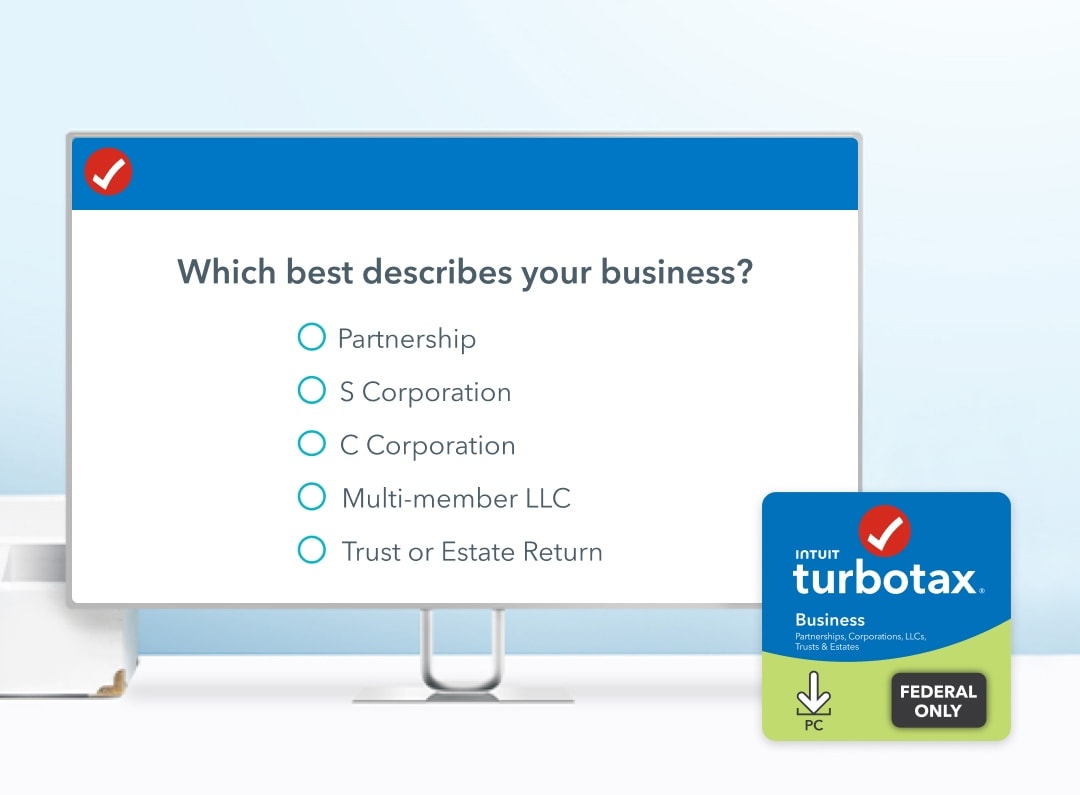

TurboTax Self-Employed Online 2022-2023 | Self Employment … Web18/10/2022 · TurboTax Online Business Products: For TurboTax Live Assisted Business and TurboTax Full Service Business we currently don’t support the following tax situations: C-Corps (Form 1120-C), Trust/Estates (Form 1041), Multiple state filings, Tax Exempt Entities/Non-Profits , Entities electing to be treated as a C-Corp, Schedule C Sole … Rules for Claiming a Dependent on Your Tax Return - TurboTax Web01/12/2022 · Key Takeaways • For tax year 2022, the Child Tax Credit is up to $2,000. The Credit for Other Dependents is worth up to $500. • The IRS defines a dependent as a qualifying child (under age 19 or under 24 if a full-time student, or any age if permanently and totally disabled) or a qualifying relative. • A qualifying dependent can have income … Tax Filing Requirements for Children - TurboTax Tax Tips Web01/12/2022 · Audit Support Guarantee: If you receive an audit letter based on your 2022 TurboTax individual, TurboTax Live Assisted Business, or TurboTax Full Service Business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center, for audited returns filed with … Let's get started on your download. - TurboTax - Intuit Child tax credits; Student loan interest deduction. Situations not covered: Itemized deductions; Unemployment income reported on a 1099-G; Business or 1099-NEC ...

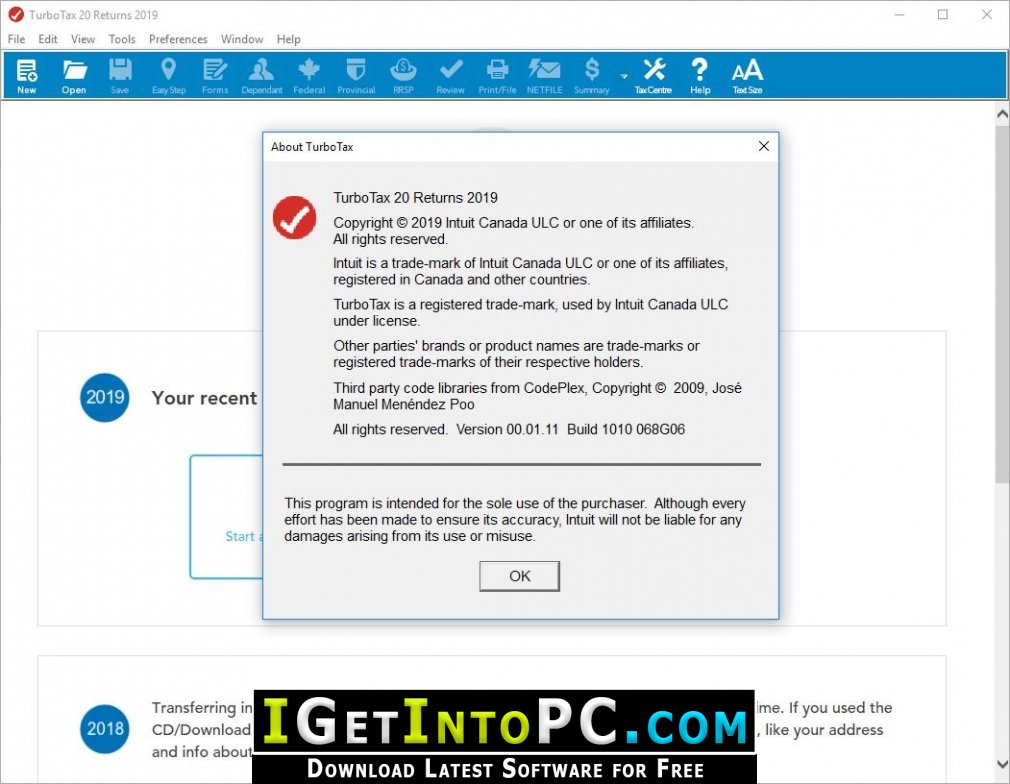

Depreciation of Business Assets - TurboTax Tax Tips & Videos Web01/12/2022 · These tips offer guidelines on depreciating small business assets for the best tax advantage. An asset is property you acquire to help produce income for your business. For tax purposes, there are six general categories of non-real estate assets. Each has a designated number of years over which assets in that category can be depreciated. Here … [Old Version] Intuit TurboTax Home & Business 2021, Federal … Web24/10/2021 · turbotax 2017. payroll software. Next page. Product details. Date First Available : October 24, 2021; Manufacturer : Intuit; ASIN : B09FWR8GFJ; Best Sellers Rank: #61 in Software (See Top 100 in Software) #20 in Tax Preparation; Customer Reviews: 4.5 out of 5 stars 4,320 ratings. Product Description . Get your taxes done right … Intuit TurboTax Home & Business for Tax Year 2017 INT940800F065 Shop Intuit TurboTax Home & Business for Tax Year 2017 at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up. turbotax.intuit.com › tax-tips › small-businessThe Home Office Deduction - TurboTax Tax Tips & Videos Dec 08, 2022 · Audit Support Guarantee: If you receive an audit letter based on your 2022 TurboTax individual, TurboTax Live Assisted Business, or TurboTax Full Service Business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center, for audited returns filed with these products ...

ttlc.intuit.comTax Support: Answers to Tax Questions | TurboTax® US Support The TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics.

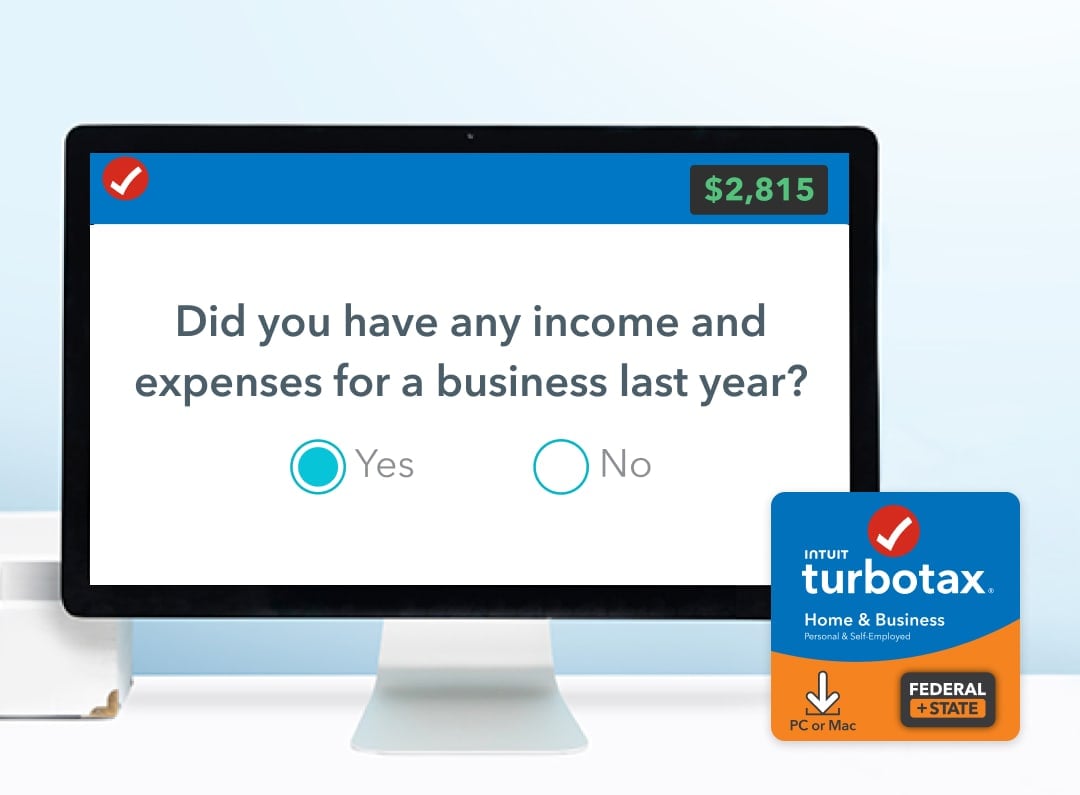

Download TurboTax Home & Business 2017 Tax Software Online ... Get your taxes done right with TurboTax 2017 TurboTax is tailored to your unique situation—it will search for the deductions and credits you deserve, so you're ...

turbotax.intuit.comTurboTax® Official Site: File Taxes Online, Tax Filing Made Easy Audit Support Guarantee: If you receive an audit letter based on your 2022 TurboTax individual, TurboTax Live Assisted Business, or TurboTax Full Service Business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center, for audited returns filed with these products ...

TurboTax® Official Site: File Taxes Online, Tax Filing Made Easy WebTurboTax® is the #1 best-selling tax preparation software to file taxes online. Easily file federal and state income tax returns with 100% accuracy to get your maximum tax refund guaranteed. Join the millions who file with TurboTax.

Rental Property 2018 27-Month Membership Online at ... Shop TurboTax Home and Business 2017 with Quicken Home, Business & Rental Property 2018 27-Month Membership online at best prices at desertcart - the best ...

2017 TurboTax Home & Business federal e-file & state tax return for ... Find many great new & used options and get the best deals for 2017 TurboTax Home & Business federal e-file & state tax return for PC & Mac CD at the best ...

2017 Turbotax Home Business FOR SALE! - PicClick Intuit TurboTax Home & Business 2018 Tax Preparation Software. $99.00 Amazon ; 2016 TurboTax Home & Business Fed + State + Fed Efile Tax Software (PC and Mac) ( ...

Buying Your First Home - TurboTax Tax Tips & Videos Web02/12/2022 · You can't deduct these expenses now, but when you sell your home the cost of the improvements is added to the purchase price of your home to determine the cost basis in your home for tax purposes. Although most home-sale profit is now tax-free, it's possible for the IRS to tax you on the profit when you sell. Keeping track of your basis will …

The Home Office Deduction - TurboTax Tax Tips & Videos Web08/12/2022 · Key Takeaways • You may qualify for the home office deduction if you use a portion of your home for your business on a regular basis. a home can include a house, apartment, condominium, mobile home, boat or similar structure. • Generally, your home office must be either the principal location of your business or a place where you …

Home Improvements and Your Taxes - TurboTax Tax Tips & Videos Web01/12/2022 · TurboTax Product Support: Customer service and product support hours and options vary by time of year. #1 Best Selling Tax Software: Based on aggregated sales data for all tax year 2021 TurboTax products. Deduct From Your Federal Refund: A $40 Refund Processing Service fee applies to this payment method. Prices are subject to change …

Tax Support: Answers to Tax Questions | TurboTax® US Support WebThe TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics.

turbotax.intuit.com › tax-tips › home-ownershipHome Improvements and Your Taxes - TurboTax Tax Tips & Videos Dec 01, 2022 · TurboTax Product Support: Customer service and product support hours and options vary by time of year. #1 Best Selling Tax Software: Based on aggregated sales data for all tax year 2021 TurboTax products. Deduct From Your Federal Refund: A $40 Refund Processing Service fee applies to this payment method. Prices are subject to change without notice.

![TurboTax 2019 Home & Business Software CD [PC and Mac] [Old Version]](https://m.media-amazon.com/images/I/41kqalhswML._AC_SY780_.jpg)

![TurboTax Business Incorporated 2020 [PC Download] : Amazon.ca ...](https://m.media-amazon.com/images/I/71f8RJLTBrL._AC_SX342_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/S6MXK56WSVMWDF2YH6B6O4MFGI.jpg)

0 Response to "38 turbotax home and business 2017 best price"

Post a Comment